Navigating Gold Investments: A Comprehensive Guide for Investors

Gold: A Timeless Treasure for Indian Investors

Gold has always been more than just a shiny metal for Indians. It is woven into the cultural fabric, representing wealth, status, and security. But beyond its cultural significance, gold has played a crucial role as a currency and a safe haven for centuries. Let’s take a journey through time and understand why gold remains relevant and appealing, especially for Indian investors.

The Historical Significance of Gold

Gold's allure isn't a recent phenomenon. It has been cherished for thousands of years, dating back to ancient civilizations. In India, gold has been a symbol of prosperity and a means of exchange long before modern currencies existed. Kings and queens adorned themselves with gold, and it was often used in trade and as a measure of wealth. The tradition of gifting gold during weddings and festivals continues today, underscoring its enduring value.

Even in Indian mythology, the love for gold is well-documented. Remember the stories of gods and goddesses decked out in gold jewellery? Lord Kubera, the god of wealth, is often depicted with pots of gold, and even Lakshmi, the goddess of prosperity, is usually shown showering gold coins. Clearly, even the divine beings could not resist the charm of this precious metal! It seems like the gods had an eye for good investments long before we did. Needless to mention The Padmanabhaswamy Temple in Kerala unveiled a centuries-old treasure, including gold worth around $13 billion, highlighting extraordinary wealth.

Golden Chemistry

Let's take a nostalgic trip back to 8th-grade chemistry and explore why gold truly shines as the rock star of metals. Gold is inert, means it doesn't tarnish or corrode, unlike iron and copper, which seem to rust at the drop of a hat. Its malleability and ductility allow it to be hammered into sheets so thin they make paper look thick and stretched into wires that could encircle the globe. Gold is also an excellent conductor of electricity and heat, making it indispensable in electronics. Additionally, gold nanoparticles serve as catalysts in specific reactions, though they're a bit more subtle compared to their flashier counterparts, platinum and palladium.

Understanding gold's chemistry is crucial because it underscores the metal's intrinsic value beyond its lustre. Unlike other metals, gold's unique properties give it irreplaceable practical industrial uses, ensuring its continued importance in various fields. This intrinsic value is what sets gold apart, making it more than just a decorative metal—it's a versatile and valuable resource in its own right.

Why Gold is Still Relevant Today

Apart from its industrial usage, there are several factors contribute to gold's continued relevance:

1. Cultural Significance: For many Indians, gold is more than an investment; it is a part of life's milestones. From weddings to festivals like Diwali, gold plays a central role in celebrations and rituals. It is often considered auspicious and is a preferred gift that signifies good fortune and wealth. In fact, gifting gold during these occasions is almost like an unspoken rule—current estimates suggest Indian household has 25,000 tonnes of gold. It is not uncommon to see families investing in gold jewellery, not just for the sparkle but also for the future. Plus, let's be honest: nothing says "I love you" quite like a gold necklace... or at least, that's what every bride's family seems to think!

2. Hedge Against Inflation: Gold has historically been a good hedge against inflation. When the cost-of-living increases, the value of currency often decreases, but gold tends to hold its value or even appreciate. This makes it a popular choice for preserving purchasing power over time.

3. Safe-Haven in Uncertain Times: Gold is often referred to as a "safe haven" asset. During economic downturns or geopolitical instability, investors tend to flock to gold because it is seen as a stable store of value. It's like the security blanket of the financial world—when things get shaky, people find comfort in its reliability. Recent examples like the Russia-Ukraine conflict and tensions in the Middle East have reminded investors of gold's appeal during turbulent times. Such geopolitical events create uncertainty in global markets, leading many to turn to gold as a safeguard against potential losses. In today’s world, where economic and political uncertainties seem to be a regular feature in the news, gold often provides a sense of security and peace of mind.

4. Diversification: For investors, diversification is key to managing risk. Gold often moves inversely to stock markets (refer exhibit1), meaning when stocks are down, gold may rise. This makes it an effective way to diversify a portfolio and reduce risk.

Exhibit 1

The Economics of Gold

Recently we saw gold price falling 7-8% from its peak ~76000 per 10 gm due to change in custom duty from 15% to 6% in the Union Budget of July 23, 2024. This reduction decreased import costs, making gold cheaper for traders and consumers. As a result, increased gold imports led to a higher supply in the domestic market. The market adjusted to the expectation of lower prices due to the reduced duty and greater availability, which led to an immediate drop in gold prices. The overall impact of the duty cut was a stabilization of gold prices by aligning them with lower import costs and increased supply.

India imports gold priced in U.S. dollars, leading to several key considerations:

1. Dollar Pricing: Gold is priced in U.S. dollars, so its cost in India changes with the dollar-to-rupee exchange rate. For example, in 2022, as the dollar strengthened from ₹74 to ₹83, gold prices in India surged. Conversely, when the rupee appreciated against the dollar in early 2023, gold prices in India dropped, making it cheaper for Indian buyers.

2. Import Costs: India imports most of its gold, and fluctuations in global prices and import duties affect local prices. A recent example is the Union Budget of July 23, 2024, which reduced the customs duty on gold from 9% to 6%. This cut aimed to lower import costs and stabilize local prices. Following the announcement, gold prices in India initially dropped due to the reduced import costs, making gold more affordable for consumers and traders.

3. Supply and Demand: The price of gold is influenced by supply and demand dynamics. Mining new gold is costly and time-consuming, which means supply is relatively stable. However, demand can fluctuate based on factors like investment trends, central bank policies, and consumer behaviour, particularly in large markets like India and China.

4. Global Market: Unlike some assets, gold has a global market. Its price is quoted in major currencies and it is traded worldwide. This makes it a truly global asset that is not confined by national boundaries.

5. No Counterparty Risk: Gold does not come with counterparty risk, unlike stocks or bonds. This means its value does not depend on the performance or solvency of a particular entity. This characteristic adds to its appeal as a secure asset.

Gold as various investment avenues

There are multiple ways to invest in gold:

1. Physical Gold: This includes gold jewellery, coins, and bars estimates suggest that Indian households collectively own around 25,000 to 30,000 tonnes of gold, with a significant portion being in jewellery. This makes India one of the largest private holders of gold in the world. While culturally significant, it comes with challenges like storage and security.

2. Gold ETFs and Mutual Funds: These are convenient options that allow you to invest in gold without the need to physically hold it. They are traded on stock exchanges and offer liquidity and ease of investment.

3. Sovereign Gold Bonds: Issued by the government, these bonds are a great way to invest in gold with added interest earnings. They are a secure and efficient way to invest in gold without the hassle of physical storage. As of early 2024, the total amount of SGBs issued was around 1,000 tonnes of gold. This figure is growing as more investors shift from physical gold to SGBs for their convenience and returns.

4. Digital Gold: An emerging option, digital gold allows you to buy and sell gold online in small quantities. It is a convenient and modern way to invest in gold.

RBIs love affair for Gold: Do you know RBI has 800 tonnes of physical Gold.

So, recently, the RBI made headlines by bringing back 100 tonnes of gold from the UK to India. You might wonder, how did this gold end up in the UK in the first place? Don’t worry, it’s not the colonial loot from the British era. This was RBI’s own stash of gold that was parked in UK vaults, along with some gold in Swiss banks and the US Federal Reserve.

Now, why did RBI keep gold abroad in the first place? Well, it was mostly about security and convenience. The UK, Switzerland, and the US offered top-notch safety and were key financial hubs, making it easy for the RBI to manage its reserves globally.

But here’s why RBI is calling the gold back now: Geopolitical tensions are on the rise. With conflicts in the Middle East and the ongoing Russia-Ukraine war, RBI is feeling a bit jittery about keeping so much gold outside the country. Gold is like a financial safety net—it helps protect against economic shocks and currency fluctuations, so having it close to home makes sense in these uncertain times.

Gold also plays a crucial role in monetary policy. It’s a solid hedge against inflation and currency devaluation, which means it helps keep the national currency strong and boosts confidence in the economy.

In short, RBI is bringing gold back to ensure its secure and ready to support India’s financial stability amid global chaos.

Equities Vs. Gold

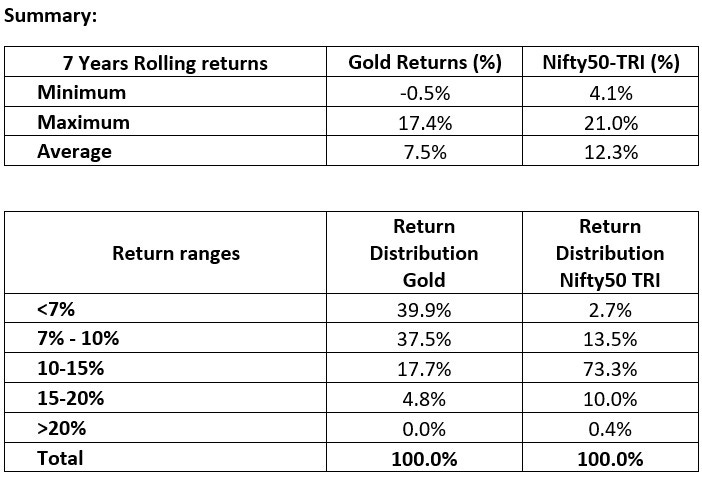

When comparing returns, I prefer using rolling returns rather than point-to-point CAGR, as it reduces recency bias. I find a 7-year time horizon to be a balanced period—neither too long nor too short for analysis, Nifty50 and Gold data are taken since Apr 2007 till June 2024.

Key Insights from the Analysis:

1. Nifty50 vs. Gold Performance: Nifty50 investors saw average returns of 12.3%, well above gold's 7.5%. Respectively gold served as a modest hedge, slightly outpacing inflation.

2. Best 7-Year Returns: At its peak, Nifty50 yielded 21%, while gold returned 17.4%, highlighting equities' higher potential during strong market phases.

3. Return Distribution Insight: Nifty50 consistently delivered returns in the 10-15% range 73% of the time, compared to gold's 17.7%, demonstrating more stable performance.

Nifty50 emerges as the clear winner, proving its resilience and consistent performance over time and trust me, I've run these iterations over different time periods like 3, 5, and 10 years, and the results consistently favored Nifty50. However, this doesn't mean gold is a substandard investment. While Nifty50 has generally outperformed gold over 7-year rolling returns, there have been notable periods where gold outshined (refer to Exhibit 1). The real challenge lies not in choosing the asset class but in timing—knowing when equities or gold will outperform each other.

While there is no crystal ball to predict the future of investments, however few macroeconomic indicators can provide valuable insights to guide our choices. However, it is crucial to remember that the idea isn't to completely shift from equities to gold and back, as this approach incurs significant transition costs and taxes. Especially with the recent tax laws post the July 2023 Budget, such moves can erode your gains, particularly if you're making short-term investments.

Moreover, macroeconomic indicators aren't foolproof; they can sometimes be deceptive. Therefore, a prudent strategy is to maintain a moderate allocation to gold, perhaps 5-10% of your overall portfolio. This balance can help mitigate risks, depending on your risk tolerance and capacity to handle market fluctuations.

Conclusion

In conclusion, both gold and equities have their unique merits and roles in an investment portfolio. Nifty50 has demonstrated its strength with consistent returns, making it an appealing choice for long-term growth. However, gold's enduring value and cultural significance in India, coupled with its role as a hedge against inflation and economic uncertainty, make it a vital component for diversification.

Investors should avoid completely shifting between these asset classes based on market conditions. By staying informed and considering macroeconomic indicators, investors can better navigate the complexities of the market, ensuring a well-rounded and resilient portfolio.

Moreover, consulting a financial expert can be invaluable. Professionals can assess your financial goals, risk tolerance, and market conditions, providing personalized advice that aligns with your long-term objectives. Their expertise helps manage the nuances of investment strategies, from asset allocation to tax planning, ensuring that your portfolio is optimized for growth and security. Ultimately, the key lies in understanding the strengths and limitations of each asset class and aligning them with your financial goals, with expert guidance ensuring that you're on the right path.

Disclaimer: The content of this article is intended for educational purposes only and should not be considered as financial advice, investment tips, or recommendations. The information provided is based on general market observations and historical data, and it does not account for individual financial situations or objectives. Readers are encouraged to consult with a qualified financial advisor before making any investment decisions. The author and publisher assume no responsibility for any actions taken based on the content of this article.