Newsletter: Navigating Recent Volatility in the Indian Equity Market

Dear Investors,

The last six days have seen the broader Indian market index, Nifty 50, correcting by 5%. While this may raise concerns, it’s essential to examine the causes behind this decline and why India's long-term growth story remains resilient.

1. Market Valuation Correction

India’s equity market has been riding high on a premium, supported by its strong growth forecast. However, compared to peer economies, valuations became stretched, and this recent correction reflects a natural market rebalancing. While the premium might adjust in the short term, India's fundamental growth outlook remains robust.

2. China’s Stimulus and FII Outflows

The second key factor has been China’s recent economic stimulus to revive its economy. Over the past 6.6 years, China's equity market underperformed, showing a negative CAGR of 7.7%. But since the announcement of the stimulus, China’s Hang Seng Index has risen by 20% (as of September 25, 2024). The renewed optimism around China attracted Foreign Institutional Investors (FIIs), prompting them to redirect funds from Indian equities to capitalize on China's recovery at cheaper valuations.

3. Geopolitical Tensions: Iran-Israel Conflict

The geopolitical crisis unfolding between Iran and Israel has also contributed to global market volatility. Israel's retaliation after a direct attack by Iran has heightened uncertainty, fueling investor caution globally. However, this appears to be a temporary factor influencing market sentiment rather than a long-term deterrent for India's markets.

India's Long-Term Growth Story Remains Intact

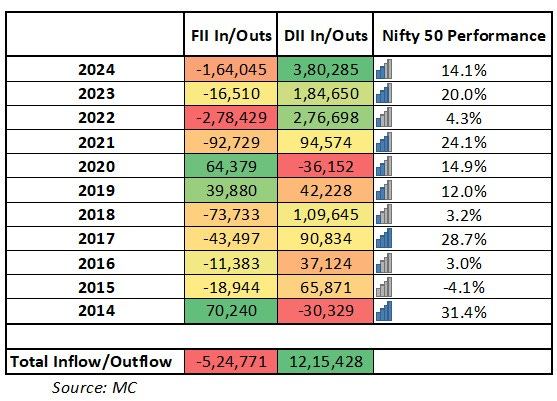

Despite these short-term pressures, the resilience of the Indian market remains evident. Former U.S. Treasury Secretary Larry Summers and OECD Chief Economist Álvaro Pereira continue to emphasize India’s strong growth trajectory. Data also supports this optimism—while FIIs have been net sellers of ₹1.64 lakh crore in 2024, Domestic Institutional Investors (DIIs) have stepped up, investing ₹3.8 lakh crore, the highest in Indian equity market history.

FII vs. DII Inflows/Outflows

The table below highlights the contrasting flows between FIIs and DIIs over the last decade:

In total, FIIs have been net sellers to the tune of ₹5.24 lakh crore over the last decade, while DIIs have been net buyers, adding ₹12.15 lakh crore into the market. This structural shift highlights how domestic participation—led by mutual funds, insurance companies, and pension funds—has bolstered the market even as FIIs retreat.

The Role of Retail Investors

A significant portion of DII inflows—₹9.36 lakh crore (77%)—occurred post-COVID-19. Many of these investors have only seen a rising market in the last four years, earning the nickname "Covid ki baad ki Janta." These investors may not be familiar with prolonged market consolidations or deep corrections, such as the “K-shaped” recoveries that veterans warn about. While Indian equities have delivered stellar returns, it's crucial for retail investors to maintain a rational approach and understand that markets can experience periods of volatility or extended consolidation.

Looking Ahead

While the recent correction may cause short-term discomfort, it’s important to focus on the fundamentals. Indian equities continue to be one of the most attractive asset classes globally. However, investing requires patience, expertise, and, above all, temperament. The coming months may be challenging for retail investors with a short-term view, but for those with a disciplined, long-term perspective, the potential remains bright.

Stay invested, stay pragmatik!

Warm regards,

Dishant

Founder, Pragmatik Investing

(Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Please consult your financial advisor before making any investment decisions.)