India’s Equity Market: Faster Recoveries, Fewer Dips — The Stock Market’s New Normal

India’s equity market, much like an experienced mountaineer, has scaled numerous peaks, braved several storms, and encountered treacherous descents. Yet, with each passing year, it has learned to adapt and recover more swiftly from setbacks. If the Nifty 50 were an expedition, its theme would be perseverance — bouncing back from market drawdowns with renewed strength, much to the relief of investors who’d rather avoid being stranded in any long-winded financial avalanches.

Recoveries Getting Shorter: From a Marathon to a Sprint

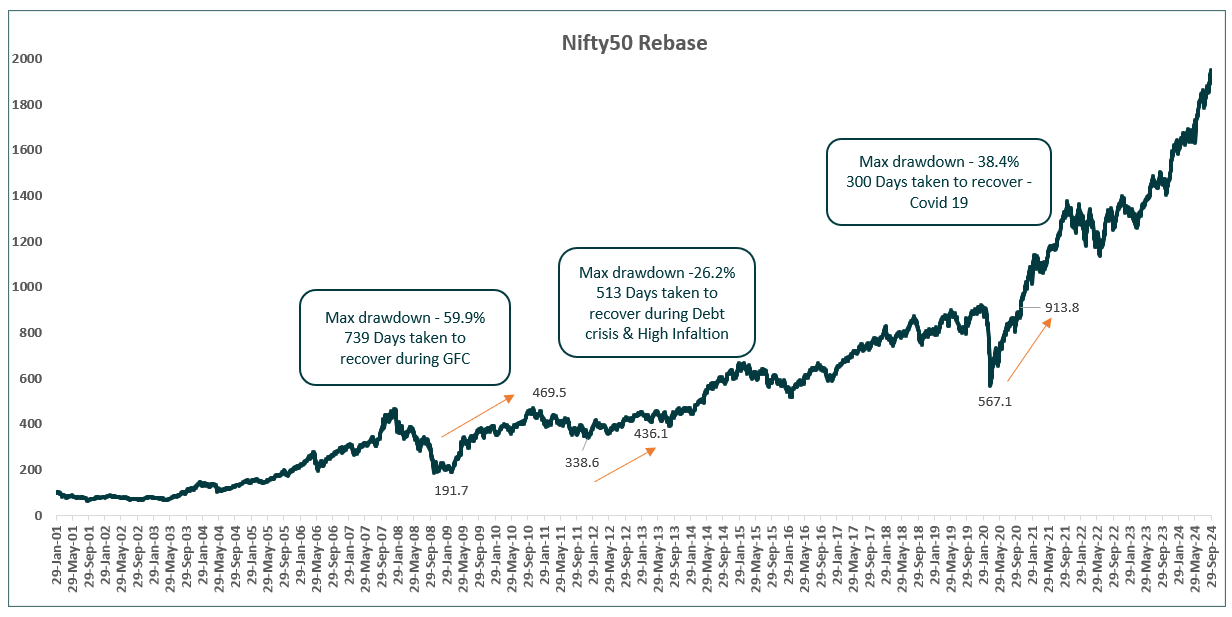

In the early 2000s, recovering from a market crash was like a slow uphill trek. For instance, during the Global Financial Crisis of 2007-2008, the Nifty 50 experienced a gut-wrenching 59.9% drawdown. It took a grueling 739 days — roughly two years — to get back on track. That was the era when market corrections felt like marathons, leaving investors exhausted and in suspense for extended periods.

Fast forward to the inflation crisis and global debt scare that plagued the decade from 2011 to 2020. Though the drawdown was a milder 26.2%, the market still took 513 days to recover. The recovery speed had picked up, but the race was still long.

Then came COVID-19 — a sudden, sharp market crash in 2020. However, this time, the Nifty 50 recovered in just 300 days from a 38.4% drawdown. The shift from long recovery periods to shorter, more efficient ones highlights how the market has become more resilient over time, with corrections now looking more like sprints than marathons.

Source:NSE

Liquidity: The Fuel That Powers the Engine

One of the key reasons for this faster recovery is liquidity, which has become the fuel that powers the engine of the market. In the past, the Indian stock market was like a car dependent on imported fuel — relying heavily on Foreign Institutional Investors (FIIs) and Foreign Portfolio Investors (FPIs) to drive growth. But today, Domestic Institutional Investors (DIIs) and retail investors have become the renewable energy sources, steadily pumping funds into the market through avenues like Systematic Investment Plans (SIPs). With SIPs crossing ₹23,500 crore per month in August 2024, this liquidity provides a constant supply of fuel, ensuring that the market engine keeps running smoothly, even when global uncertainties cause FIIs to pull out.

Households to the Rescue: Investing is the New Cricket

From 2019 to 2024, there’s been a significant shift in how Indian households handle their money. Once upon a time, fixed deposits were like Tendulkar in the 90s — reliable, steady, and everyone’s favorite. But now, equity is the new Kohli — aggressive, dynamic, and the preferred choice for building wealth. With more Indian families ditching their savings accounts and embracing equity, the market corrections are becoming shorter-lived. After all, when everyone is rushing to buy the dip, there’s hardly any dip left!

Fewer Opportunities: Fasten Your Seatbelts, This Ride is About to Get Faster

As more investors flood into the market, we’re entering a new phase: corrections will become brief windows of opportunity. Blink, and you might miss them. Like a flash sale on Flipkart, market dips will get scooped up fast by eager investors armed with liquidity. And let’s not forget our beloved Finance Minister, Nirmala Sitharaman, who seems to increase taxes on capital gains with the same frequency as China advances on the Siachen border.

Before February 2018, there was no Long-Term Capital Gains (LTCG) tax — those were the good old days. Then came the 10% tax, and now it’s 12.5%. If you think this trend won’t continue, you’re as optimistic as an ITC investor waiting for the stock to move. The grandfathering rule, which adjusts your cost basis from the implementation date, only favors those who got in early. For new investors, the rising tax burden is becoming an increasing concern. So, it’s better to dive into equities early before the tax structure gets heavier — a case of "first movers enjoy the real benefit!"

Conclusion: The Market’s New Formula

In the post-COVID world, the Nifty 50 has not just survived — it has thrived. Since March 2020, it has delivered 28% returns, showing that India's equity market is now a leaner, faster, and more resilient beast. With domestic liquidity driving the market and household participation at an all-time high, future corrections will likely be brief, and recovery times even shorter. The lesson is clear: get in on the action now before the market matures further, and the opportunity to “buy low” becomes as rare as a quiet day on Dalal Street!

But what should investors do in this fast-evolving scenario? The answer is simple: never wait for deep corrections. As corrections become rarer and short-lived, investors who wait for the “perfect dip” may lose more by sitting on the sidelines than by deploying their money and riding the correct momentum. SIPs (Systematic Investment Plans) should continue unabated, especially for those building their future corpus. And when bigger opportunities arise, consider making a lump-sum investment to take full advantage. In the long run, staying consistently invested is far more beneficial than trying to time the market.

Disclaimer:

The information provided in this article is meant for educational purposes only and should not be interpreted as financial advice. The views expressed are based on data and trends as observed in the equity markets but should not be taken as specific recommendations for any investment decisions. Before making any financial or investment choices, readers are encouraged to consult with a qualified financial advisor who can consider their personal financial situation, risk tolerance, and investment goals. Past performance is not indicative of future results, and market conditions are subject to change.